Compound Interest Explained: The Secret to Long Term Wealth

Have you ever wondered how some people seem to effortlessly grow their wealth over time? The secret isn't always about earning more, it's about understanding how money grows through compound interest.

Whether you're saving for retirement, building an emergency fund, or paying off debt, compound interest will significantly impact your financial future. This guide breaks down everything beginners need to know about this powerful financial concept.

What Is Compound Interest?

Compound interest is interest calculated on both your original investment (the principal) and the interest that investment has already earned. In simple terms, it's "interest on interest," creating a snowball effect that accelerates your money's growth over time.

Think of it like a snowball rolling down a hill. As it rolls, it picks up more snow, becoming larger and gathering even more snow with each rotation. Your money works the same way, the interest you earn begins earning its own interest, creating exponential growth.

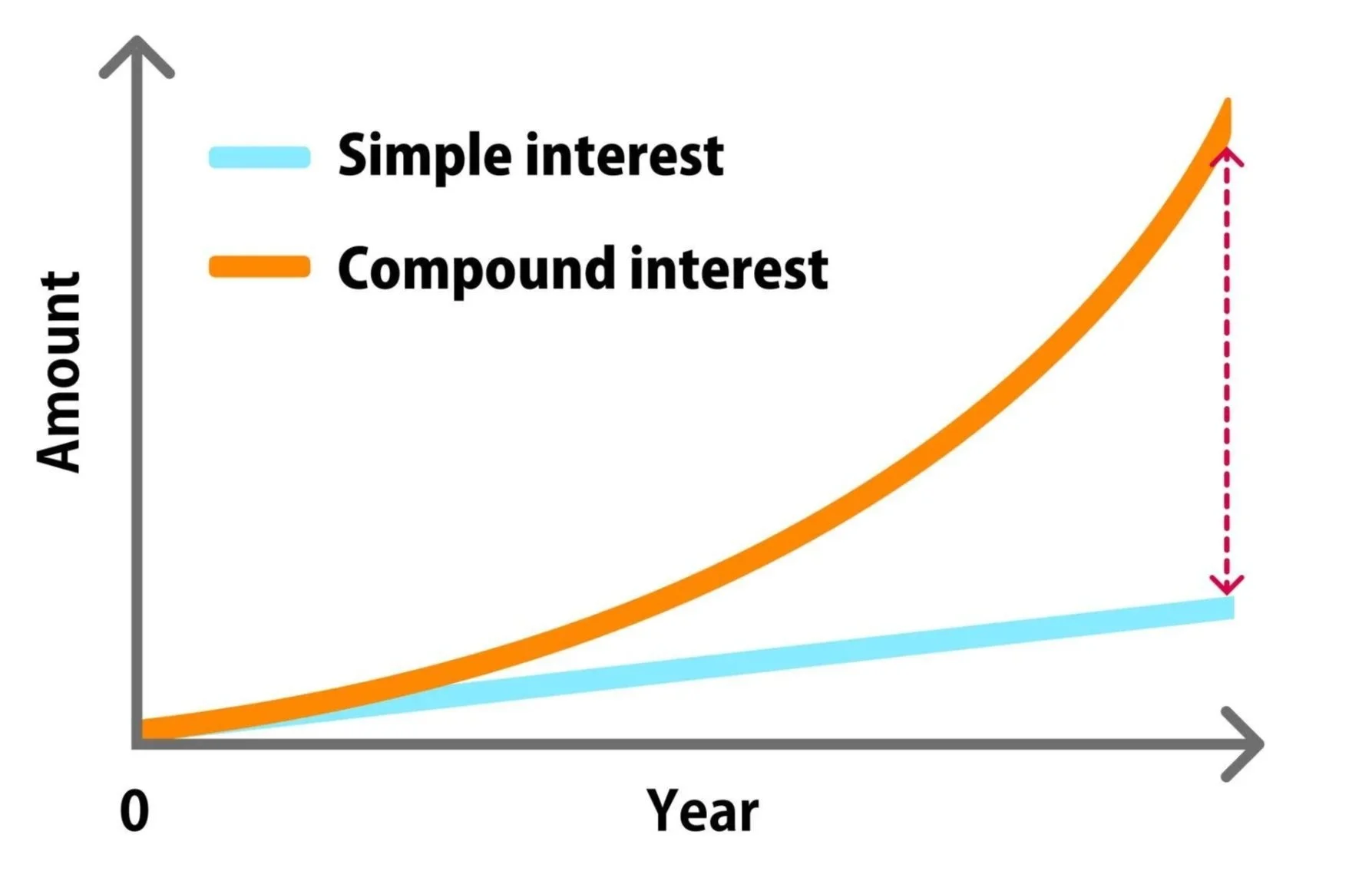

Compound Interest vs Simple Interest: What's the Difference?

Understanding the distinction between these two types of interest is crucial:

Simple Interest only applies to your original principal. If you invest £10,000 at 5% simple interest for three years, you earn £500 per year, totaling £1,500 in interest.

Compound Interest applies to both your principal and accumulated interest. Using the same £10,000 at 5% compounded annually for three years, you'd earn £1,576.25, an extra £76.25 simply because your interest earned its own interest.

While £76 might not seem substantial over three years, the difference becomes dramatic over longer periods.

Why Compound Interest Is So Powerful

1. Time Is Your Greatest Asset

The earlier you start saving or investing, the more time compound interest has to work its magic.

Consider two savers:

Sarah starts investing £200 per month at age 25 and stops at 35, investing for just 10 years (£24,000 total).

At a 7% annual return, by age 65, she'll have approximately £268,000.

James starts investing £200 per month at age 35 and continues until 65, investing for 30 years (£72,000 total).

At the same 7% return, he'll have approximately £244,000.

Sarah invested £48,000 less but ended up with £24,000 more, all thanks to starting 10 years earlier.

2. Small Amounts Add Up

You don't need thousands to benefit from compound interest. Even modest, regular contributions grow significantly over time. Saving just £50 per month at 5% annual interest for 30 years results in over £41,600, with only £18,000 of your own money contributed.

3. Consistency Beats Timing

Rather than trying to time the market or waiting for the "perfect moment" to start saving, consistent contributions allow you to benefit from compound growth regardless of market conditions.

Real-World Applications of Compound Interest

For Saving and Investing

Savings Accounts: Your bank calculates interest on your balance and adds it to your account. Future interest calculations include this added amount, creating compound growth.

Investment Accounts: When you reinvest dividends from stocks or funds, those dividends purchase additional shares that generate their own dividends, compounding your returns.

Pension Funds: Retirement accounts benefit enormously from decades of compound growth, turning modest contributions into substantial retirement income.

ISAs (Individual Savings Accounts): In the UK, these tax-free accounts allow your money to compound without tax eating into your returns.

For Borrowing and Debt

Compound interest isn't just for savings, it also applies to debt, where it works against you:

Credit Cards: Most credit cards compound interest daily. A £5,000 balance at 22% APR can cost you over £1,100 in interest in just one year if you only make minimum payments.

Overdrafts: Some overdraft fees compound, making small overdrafts surprisingly expensive.

Understanding how compound interest affects debt is crucial for making informed borrowing decisions and prioritising debt repayment.

Practical Tips for Beginners

1. Start Early, Start Now

Even if you can only invest £20 per month, start today. Time is the most powerful factor in compound interest, and you can always increase contributions later.

2. Check Compounding Frequency

When choosing savings accounts or investments, compare the AER and understand how often interest compounds. More frequent compounding means faster growth.

3. Reinvest Your Returns

Automatically reinvest dividends, interest, and other returns to maximise compound growth. Don't withdraw earnings unless absolutely necessary.

4. Make Regular Contributions

Set up automatic monthly transfers to your savings or investment accounts. Consistent contributions amplify the compounding effect.

5. Use Compound Interest Calculators

Online calculators help visualize how your money will grow over time. Experiment with different scenarios to understand the impact of contribution amounts, interest rates, and time periods.

6. Prioritize High-Interest Debt

Since compound interest works against you on debt, prioritize paying off high-interest credit cards and loans before focusing heavily on investing.

7. Take Advantage of Tax-Advantaged Accounts

In the UK, maximise contributions to ISAs and workplace pension schemes to benefit from tax-free compound growth.

8. Be Patient and Consistent

Compound interest rewards long-term thinking. Avoid withdrawing funds early or stopping contributions during market downturns.

Common Misconceptions About Compound Interest

Misconception #1: "I need thousands to start benefiting from compound interest."

Reality: Even small amounts grow significantly over time. Starting with £50 per month is far better than waiting until you have more.

Misconception #2: "Higher compounding frequency always means dramatically more growth."

Reality: While more frequent compounding does increase returns, the difference between monthly and daily compounding is often minimal compared to factors like interest rate and time invested.

Misconception #3: "Compound interest guarantees wealth."

Reality: Compound interest is powerful, but investment returns aren't guaranteed. Market volatility, inflation, and fees all impact actual results.

Misconception #4: "It's too late to benefit if I didn't start in my 20s."

Reality: While starting early is ideal, compound interest benefits you at any age. Starting at 40 is better than starting at 50, which is better than never starting at all.

Key Takeaways

Compound interest is one of the most powerful concepts in personal finance. Whether saving for retirement, building wealth, or managing debt, understanding how it works helps you make smarter financial decisions.

Remember these essential points:

Compound interest is interest earned on both your principal and previously earned interest

Time is your greatest advantage, start as early as possible

Small, consistent contributions can grow into substantial wealth over time

More frequent compounding accelerates growth, but interest rate and time matter more

Compound interest works against you on debt, making it crucial to pay off high-interest balances quickly

Reinvesting returns maximizes compound growth

Use tax-advantaged accounts like ISAs to keep more of your compound gains

The secret to harnessing compound interest isn't about complex strategies or perfect timing, it's about starting now, staying consistent, and letting time do the heavy lifting.

Your future self will thank you for every pound you invest today.

This article is for educational purposes only and does not constitute financial advice. Consider consulting with a qualified financial advisor for personalized guidance based on your individual circumstances.